Just How Legal Services Can Aid You in Reporting a Foreign Gift: Key Realities and Insights

Steering through the complexities of reporting international gifts can be frightening for individuals and companies alike. Lawful services supply necessary competence in recognizing the intricate regulations that regulate these purchases. They aid establish and determine possible dangers customized compliance methods. However, several still encounter obstacles in guaranteeing adherence to these needs. This prompts the inquiry of exactly how efficient legal guidance can truly improve conformity and reduce dangers connected with foreign present coverage.

Understanding the Lawful Framework Surrounding Foreign Present

While the acceptance of foreign gifts can boost worldwide connections and foster partnership, it additionally raises intricate legal considerations that organizations should navigate. The legal structure governing foreign presents includes numerous regulations and laws, which can vary significantly throughout territories. Institutions have to understand guidelines concerning the disclosure, assessment, and potential taxes of these presents.

Conformity with federal laws, such as the Foreign Representatives Registration Act (FARA) and the Higher Education Act, is necessary for organizations getting significant international contributions. These legislations intend to assure openness and avoid unnecessary impact from international entities.

Additionally, establishments must consider ethical standards that govern gift acceptance to preserve integrity and public trust fund. By recognizing these legal ins and outs, companies can much better handle the risks connected with foreign gifts while leveraging the chances they offer for international cooperation and collaboration.

Secret Reporting Requirements for People and Organizations

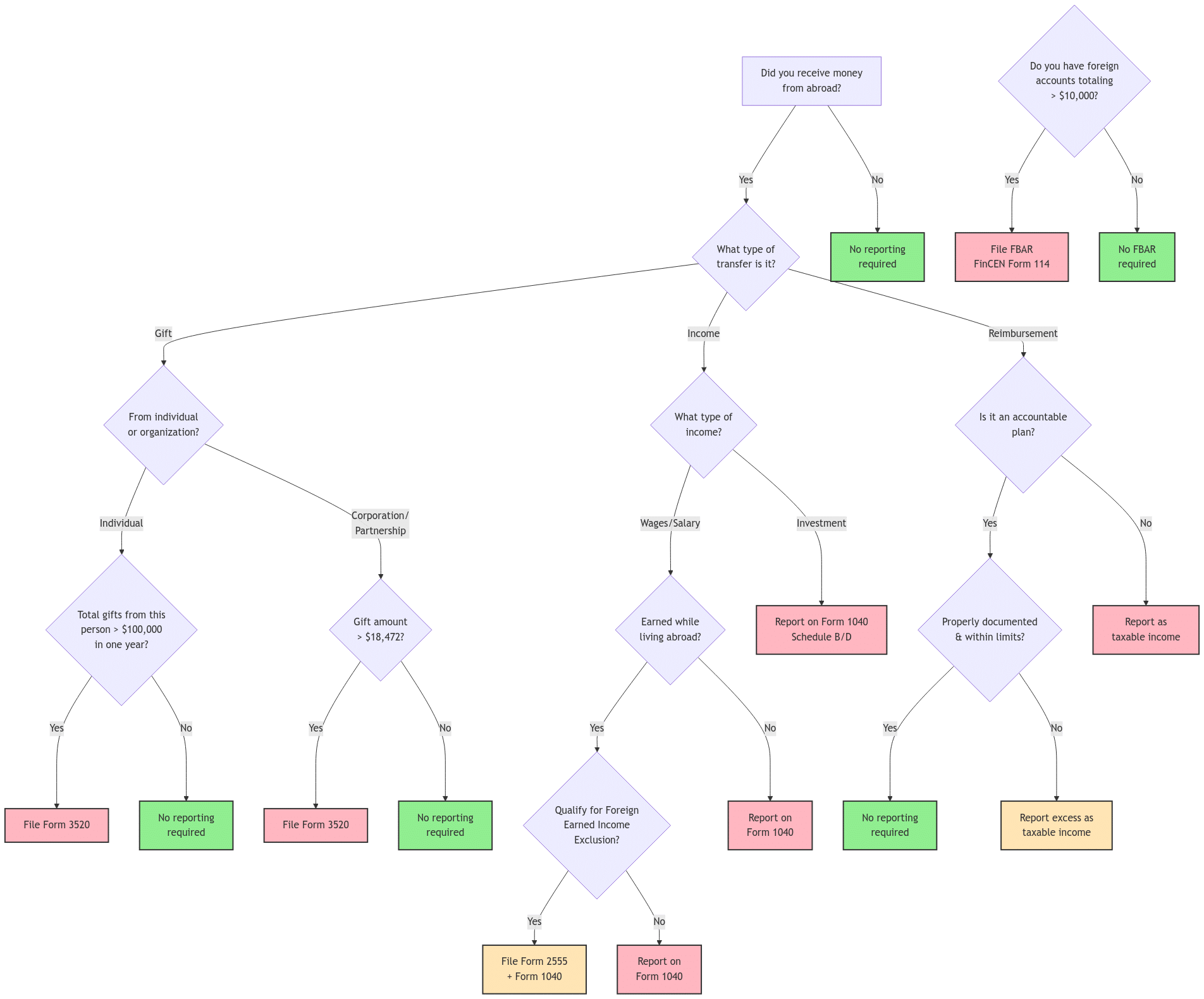

Organizations and individuals obtaining international gifts should abide by certain reporting requirements to ensure conformity with legal responsibilities. These requirements differ depending upon the jurisdiction and the nature of the present. Normally, recipients are mandated to divulge international gifts going beyond a specific monetary threshold to relevant federal government agencies. This may include detailed details regarding the contributor, the value of the gift, and its designated use.

In the United States, for instance, the Foreign Professionals Registration Act (FARA) and the Greater Education and learning Act impose distinctive reporting criteria - report a foreign gift. Establishments need to guarantee that their coverage straightens with relevant regulations to avoid fines. Individuals may also need to report gifts obtained in their capability as public authorities or staff members

Understanding these demands is crucial, as failing to report suitably can cause lawful consequences. Engaging legal solutions can facilitate conformity and aid browse the complexities of international gift coverage.

Usual Compliance Challenges and Just How to Conquer Them

Navigating the complexities of foreign present coverage frequently provides considerable conformity obstacles for receivers. One common issue is the ambiguity bordering the definition of a "foreign gift," which can result in uncertainty regarding what needs to be reported (report a foreign gift). Additionally, varying state and federal regulations can complicate adherence to coverage needs, specifically for companies operating throughout jurisdictions. Recipients may additionally have a hard time with preserving exact records, as failing to record gifts correctly can result in non-compliance

To conquer these challenges, recipients ought to establish clear inner policies regarding foreign gifts, ensuring all personnel are educated on compliance requirements. Routine audits of gift documents can help recognize disparities early. Additionally, looking for assistance from compliance professionals can offer clearness on nuances in guidelines. By proactively attending to these difficulties, receivers can better browse the check here coverage procedure and reduce the danger of penalties related to non-compliance.

The Role of Legal Solutions in Navigating Foreign Present Rules

Navigating with the detailed landscape of international present laws can be intimidating, specifically offered the possible legal ramifications of non-compliance (report a foreign gift). Lawful services play a necessary duty in leading people and organizations with this facility terrain. They provide experienced analysis of the applicable laws, making sure customers completely comprehend their commitments regarding foreign presents. Furthermore, legal experts help in determining possible dangers and liabilities connected with non-disclosure or misreporting

Ideal Practices for Ensuring Conformity With Foreign Present Reporting

Conformity with foreign present coverage demands requires an aggressive method to prevent possible challenges. Organizations ought to establish a clear plan laying out the requirements for recognizing and reporting international presents. Normal training for staff associated with the approval of presents is necessary to assure they understand reporting obligations and the implications of non-compliance.

Additionally, keeping detailed documents of all international presents obtained, consisting of the contributor's worth, function, and identity, is essential. Organizations needs to apply an evaluation process to assess whether a gift certifies as reportable.

Engaging lawful solutions can better boost conformity initiatives, providing support on intricate policies and potential exemptions. On a regular basis evaluating and upgrading internal policies in accordance with governing modifications will assist companies stay certified. Cultivating an organizational society that focuses on transparency in present acceptance can minimize dangers and enhance liability.

Frequently Asked Questions

What Sorts Of International Gifts Need Reporting?

International gifts needing reporting generally include significant monetary contributions, home, or benefits obtained from international entities, governments, or individuals, especially those going beyond details monetary thresholds set by policies, necessitating transparency to avoid possible conflicts of rate of interest.

Exist Penalties for Failing to Report a Foreign Gift?

Yes, there are penalties for falling short to report a foreign present. The repercussions can consist of fines, legal activity, and potential damages to a person's or company's credibility, stressing the relevance of conformity with reporting demands.

Can I Receive Legal Aid for Foreign Gift Coverage Issues?

Legal aid may be readily available for individuals facing visit the website challenges with international present reporting issues. Eligibility typically depends upon economic need and details conditions, motivating possible receivers to consult neighborhood lawful help companies for help.

Exactly How Can I Track Foreign Present Got In Time?

To track international gifts in time, individuals should keep in-depth records, including sources, quantities, and dates. Consistently assessing economic declarations and using tracking software program can improve precision and simplify reporting obligations.

What Documents Is Needed for Foreign Present Coverage?

Paperwork for foreign present this reporting usually includes the donor's information, gift worth, day obtained, a summary of the present, and any kind of relevant correspondence. Accurate records guarantee compliance with coverage demands and assist protect against potential lawful concerns.

Organizations and people getting international presents need to adhere to particular reporting demands to guarantee compliance with lawful responsibilities. Navigating with the complex landscape of international present laws can be daunting, particularly provided the possible lawful ramifications of non-compliance. By leveraging lawful services, customers can browse the ins and outs of foreign gift policies much more effectively, therefore lessening the risk of fines and promoting compliance. Legal help may be available for people dealing with challenges with international gift reporting issues. Documents for international gift reporting typically consists of the donor's information, gift worth, date got, a description of the gift, and any kind of relevant document.